– Recent insurance industry data places Florida as second in the nation for auto glass claims, according to the National Insurance Crime Bureau (NICB).

– Recent insurance industry data places Florida as second in the nation for auto glass claims, according to the National Insurance Crime Bureau (NICB).

“Auto glass claims have increased 52 percent over the last five years in Florida, and that suggests that there may be a corresponding rise in fraudulent activity,” said Alan Haskins, NICB’s vice president of government affairs.

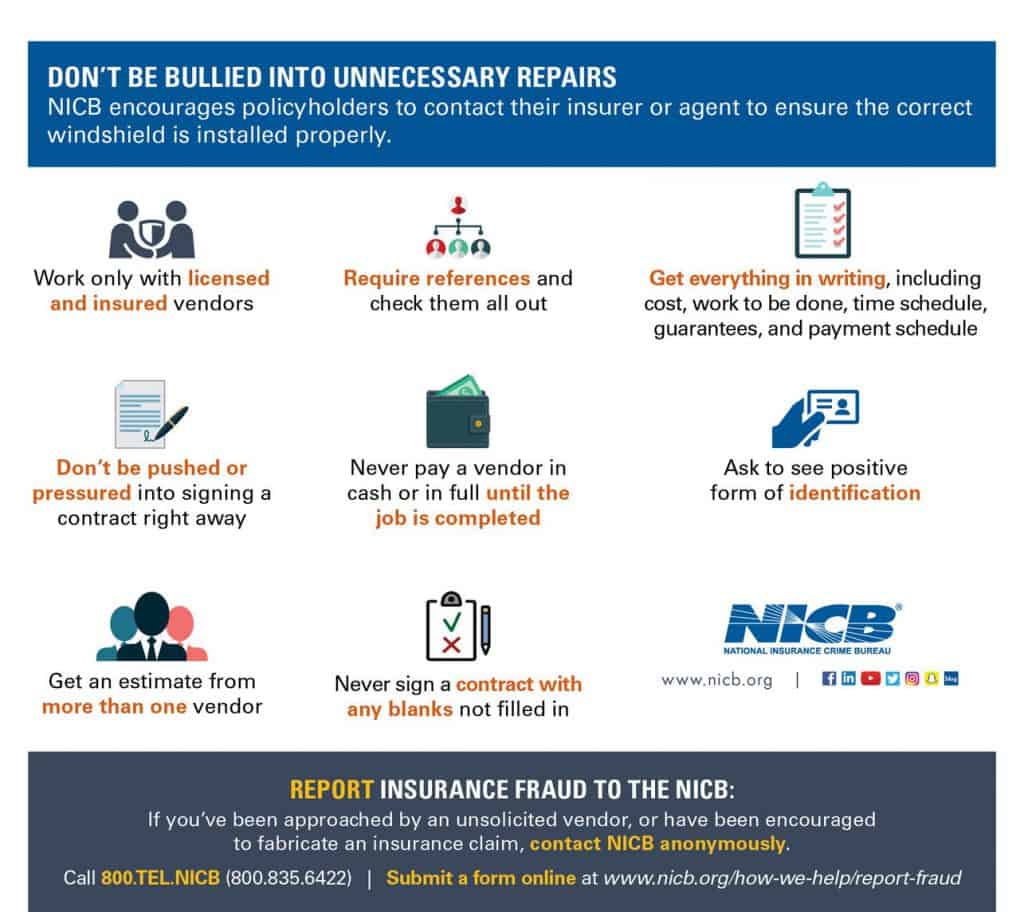

Fraudsters continue to target Florida, as they look to take advantage of policyholders by convincing them they need a windshield repair or replacement – when they might not. Some glass repair companies bill for services and never actually replace the windshield, or often replace windshields that do not have damage.

“Some fraudulent auto glass companies are convincing consumers to sign an assignment of benefits (AOB) form, which means you are giving up your rights to the auto glass company. When a consumer signs over their claim they are no longer in control if there is a dispute over inflated repairs and may be eventually named in a lawsuit. Some unscrupulous auto glass companies are turning this into a lucrative business by inflating the insurance claim and collecting the money for themselves. This type of AOB abuse is a scam and must be stopped,” added Haskins.

These lawsuits are driving up costs for consumers, as we all pay for this abuse in the form of higher insurance costs. NICB will continue to work with lawmakers Florida to stop this type of abuse against consumers.