For those who do subscribe, the experience generally earns positive marks—customers who try these services tend to remain satisfied, often recommending them to others. Still, there’s a significant downward trend in satisfaction across nearly all categories over the past few years. Navigation, personalization, and infotainment consistently emerge as the most satisfying features, while safety and security offerings lag behind. Among global respondents, those who can pay for safety and security—or EV-specific services—indicate they’ll pay the most, suggesting consumers clearly see value in these areas. By contrast, navigation and personalization services—often bundled at no extra cost by automakers—are viewed as commodities, attracting the lowest willingness to pay.

But it’s not just cost and familiarity that hamper broader adoption. Privacy skepticism looms large: consumers worry about how their driving data—everything from geolocation to driving behavior—is collected, stored, and monetized. Automobile manufacturers are pursuing recurring revenue from subscriptions, but lack of transparency in privacy policies continues to undermine consumer trust. Similarly, functionality frustration grows when households find the hardware—cameras, sensors, radars—included in a vehicle, yet essential features are locked behind paywalls. This kind of “feature fragmentation” adds confusion, and for price-sensitive consumers, recurring fees for rarely used features seem unjustifiable.

Connected services also come tangled in complexity. Many consumers simply don’t understand what these services offer or how they integrate into their ecosystem of apps and devices. Managing multiple subscriptions—navigation, safety alerts, Wi‑Fi access—via different platforms or interfaces adds friction. When automakers pitch driver assistance linked to semi-autonomous driving or EV charging support, concerns around reliability and cybersecurity persist, especially as these features intersect with evolving automated-drive capabilities.

Industry players recognize that connected services are no longer just gadget‑centered add-ons—they represent a strategic shift toward sustained revenue and deeper customer engagement. Automakers are ramping up over‑the‑air (OTA) update capabilities and cloud infrastructure, exploring whether to build in-house services or partner with third parties, often juggling multivendor cloud strategies by region. As more manufacturers introduce subscription tiers, pricing and packaging decisions will become critical to success.

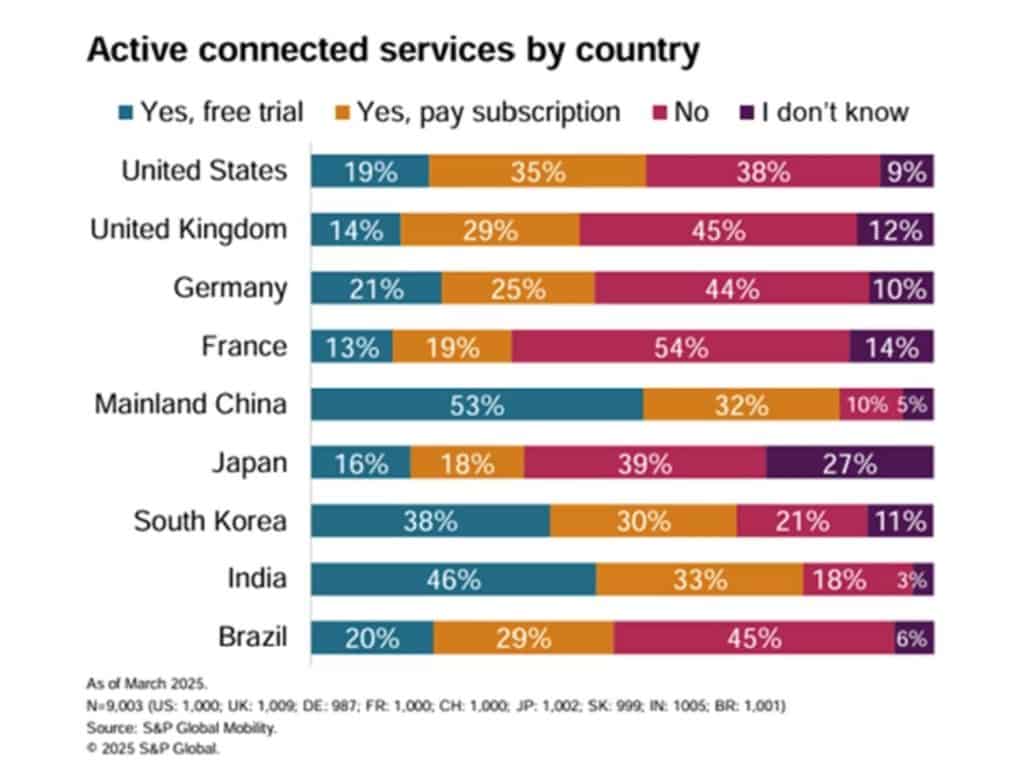

Services are not a primary consideration when choosing a new car—most often, the technology-savvy early adopters pursue these options on their own initiative. The decline in those willing to pay for connected services—from 86 percent in 2024 to 68 percent in 2025—underscores growing resistance to monthly fees for functionalities consumers believe should come standard.

Taken together, the picture that emerges is shifting consumer sentiment: those who sample connected services often stay loyal, yet an increasing share still opts out entirely. Automakers now face a two-fold challenge: establishing trust through privacy and security, and delivering enough visible value to justify monthly subscriptions. Without transparent, bundled, and user-friendly offerings, even elegant car software will remain underutilized—much like a phone with Wi‑Fi turned off in the corner of a living room.