Despite the volatility, overall satisfaction with the new-vehicle buying experience edged upward, climbing one point to 802 on J.D. Power’s 1,000-point scale. That modest gain, analysts say, underscores how consumer trust and clear communication can counterbalance economic uncertainty.

“Satisfaction among buyers has been gradually improving over the years, including a modest increase in 2025 despite the added uncertainties that tariffs bring,” said Stewart Stropp, vice president of automotive retail at J.D. Power. “Even in a challenging market, the fundamentals of satisfaction haven’t changed. Dealers who stay transparent, take time to educate buyers on their vehicle’s features, and maintain connections after delivery are the ones positioned for growth.”

The 40th annual SSI study, based on responses from 32,616 buyers who purchased or leased new vehicles between March and May 2025, offers an extensive look at how Americans feel about the buying process—from negotiations to delivery day. Fielded between July and September, the report measures satisfaction across six key areas: delivery, personnel, deal-making, paperwork, facilities, and dealership websites.

Tariffs Accelerate Timelines—and Budgets

Among those affected by tariffs, the response was decisive. Eighty-seven percent of buyers in both the premium and mass-market segments said they accelerated their purchase plans. Nearly 15 percent said they also spent more than they had originally budgeted. Buyers of Japanese and European brands were especially likely to fast-track purchases, reflecting concerns that tariffs could raise the cost of imported models.

Transparency in Trade-Ins Boosts Trust

Trade-in values emerged as a make-or-break factor in buyer satisfaction. While 28 percent of customers who traded in a vehicle said their offer was lower than expected, those who received a clear explanation from the dealer rated their experience significantly higher. When a dealer justified the trade-in value, satisfaction with the deal-making process averaged 800 points. When no explanation was given, it plunged to 672—a gap that highlights the crucial role of transparency.

The Post-Sale Connection Problem

The study also found that dealerships continue to falter in post-sale engagement. Nearly one in four buyers—22 percent—said they wanted a follow-up tutorial or explanation of their vehicle’s features in the weeks after purchase. More than half of those buyers, however, never received any follow-up. The missed opportunity, researchers noted, could hurt long-term loyalty and service retention, particularly as vehicles become more complex and software-driven.

Luxury and Mass Market Leaders

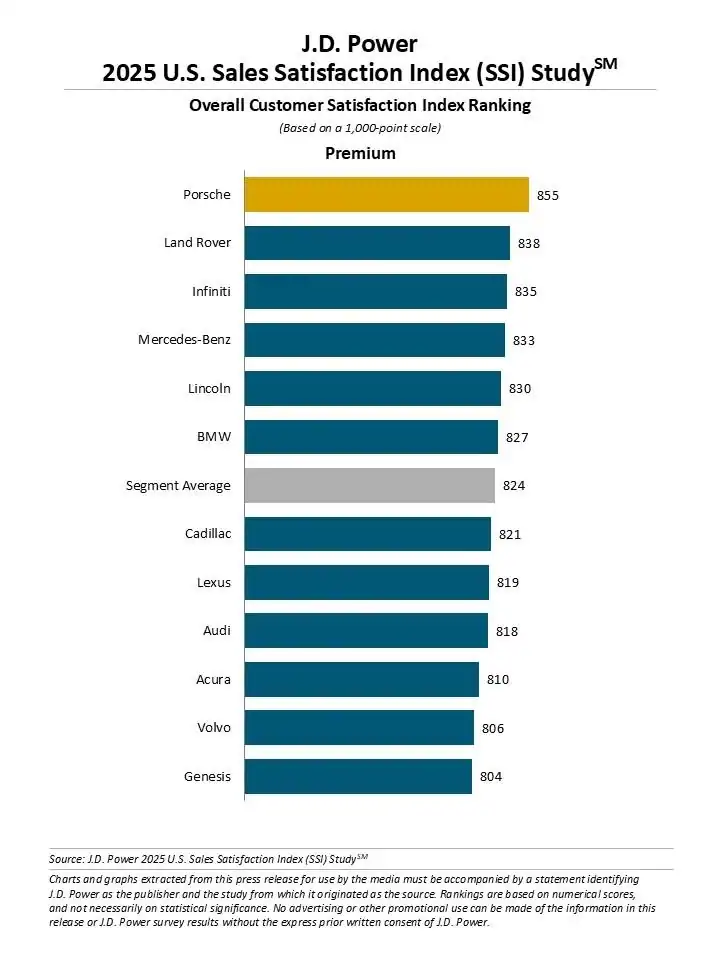

In brand rankings, Porsche once again dominated the premium category, securing the top spot for the third consecutive year with a score of 855. Land Rover followed at 838, and Infiniti ranked third at 835.

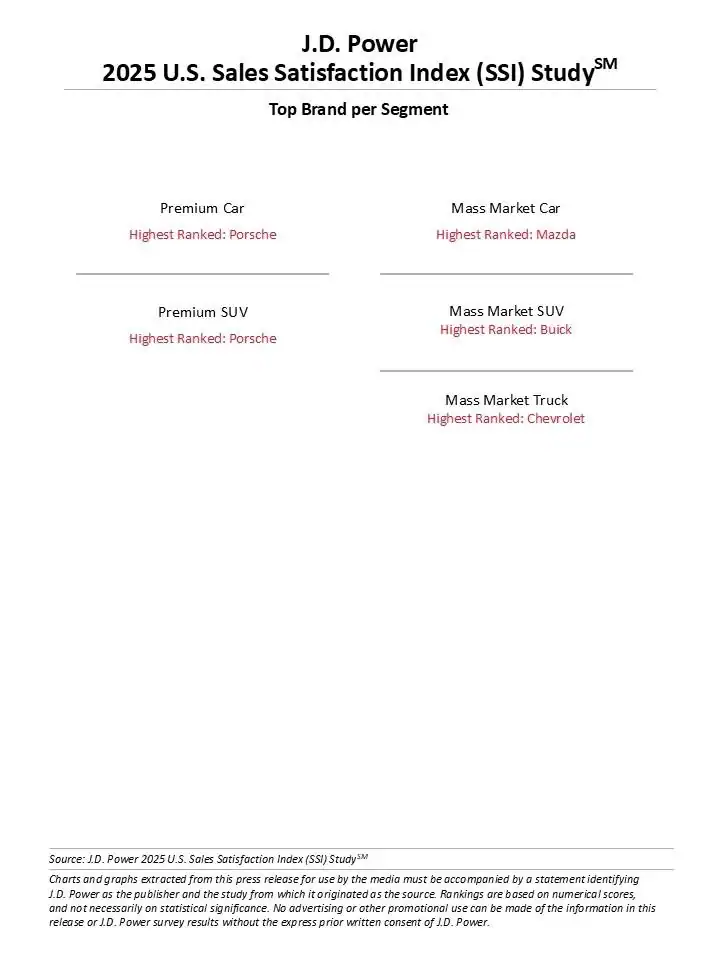

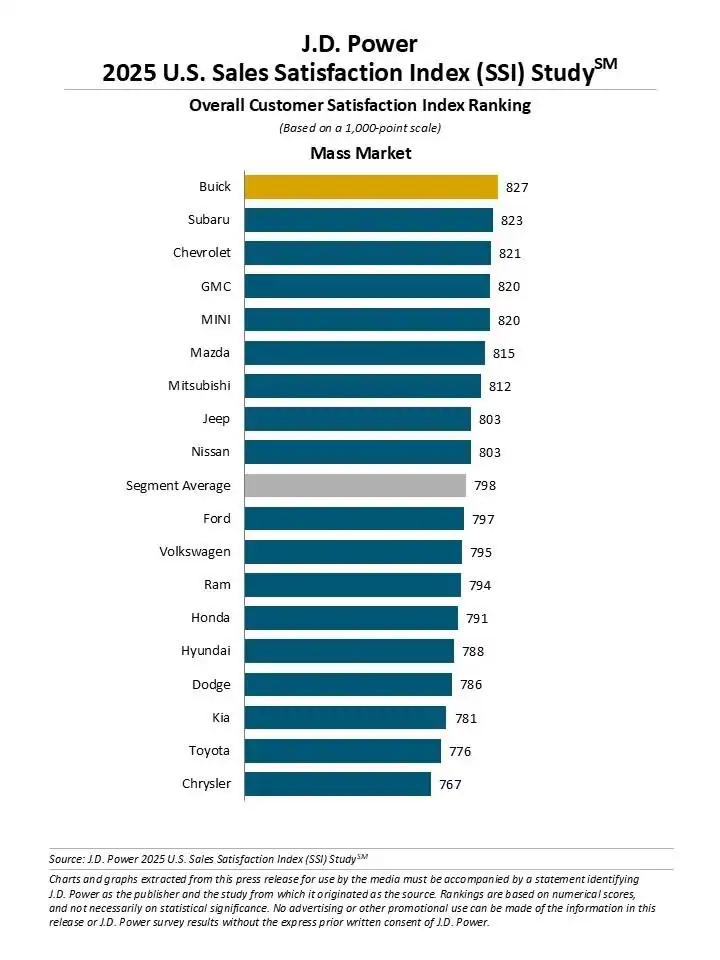

In the mass-market segment, Buick retained its lead with a score of 827, followed by Subaru at 823 and Chevrolet at 821. Segment awards went to Porsche for both Premium Car and Premium SUV, Mazda for Mass Market Car, Buick for Mass Market SUV (its second straight year at the top), and Chevrolet for Mass Market Truck.

A Changing Market, Steady Fundamentals

Now entering its fourth decade, J.D. Power’s SSI study remains a key barometer for automakers and dealers navigating shifting consumer expectations. While tariffs, economic uncertainty, and technology transitions are reshaping the market, the report suggests that the building blocks of customer satisfaction—clarity, communication, and connection—remain the same.

For consumers, the results hint at a paradox of modern car buying: amid global trade tensions and rising prices, satisfaction is still inching higher. For dealers, the message is equally clear—transparency and engagement, not just incentives, are what keep buyers coming back.

The full study and detailed brand rankings are available at www.jdpower.com/pr-id/2025147.