LexisNexis Risk Solutions, a major provider of data and analytics for the insurance and automotive industries, has released new findings that illuminate how personalized, well-timed communication can be the deciding factor in building brand loyalty and repeat purchases among U.S. car buyers. The company’s latest U.S. Automotive Brand Loyalty Mid-Year 2025 Study offers a nuanced portrait of how Americans choose their vehicles—and what makes them stay or stray from a favorite marque—as automakers navigate a shifting market defined by electrification and evolving consumer behavior.

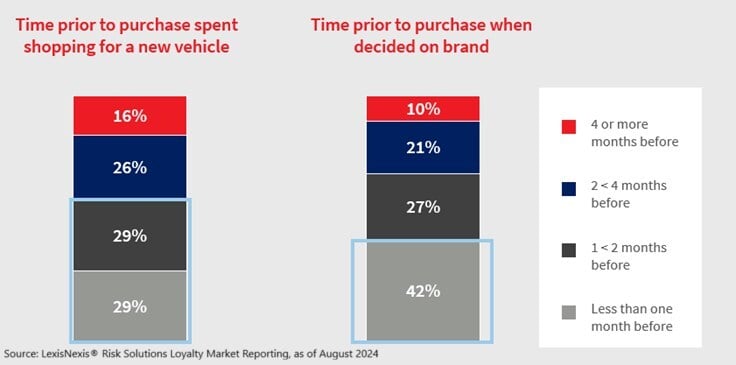

According to the report, nearly half of all U.S. consumers—42 percent—choose their vehicle brand within a month of making a purchase or lease. The data under

scores a fluid loyalty landscape: 57 percent of respondents said they were open to switching brands but still shopped first within their current brand family. Another 31 percent described themselves as steadfast loyalists, while 12 percent were “defectors” who considered only competing brands.

For households that own multiple brands, the gravitational pull of familiarity proved powerful. One in four consumers ended up defecting to another brand already parked in their driveway. The brand-switching trend was even more pronounced among traditional internal combustion engine owners transitioning to hybrid or electric vehicles—64 percent of those buyers abandoned their previous brand when going electric.

“Our survey reveals that while most consumers are inclined to repurchase from the same automaker, curiosity and familiarity often drive them toward alternatives,” said Dave Nemtuda, associate vice president at LexisNexis Risk Solutions. “With one in four consumers defecting to another brand already in their garage, automakers have an opportunity to reinforce loyalty by rethinking how and when they communicate. Data-driven insights can help them understand not just who to reach—but precisely when that outreach will make the greatest impact.”

Timing and personalization appear to be central to that equation. More than half of consumers—58 percent—begin shopping about two months before buying a vehicle, a window that has become crucial for outreach. The study found that well-targeted communication from automakers meaningfully shapes purchasing decisions.

Email remains the most influential channel, preferred by 65 percent of respondents, followed by direct mail (46 percent) and text messages (27 percent). Incentives and loyalty programs were decisive motivators: 87 percent of consumers cited financial offers as the most persuasive factor, and 86 percent said the same of loyalty programs. Close behind were exclusive offers for existing customers and detailed explanations of new model features, both ranked at 85 percent.

Other forms of engagement—such as new model announcements, competitive trade-in promotions, and personalized invitations to test-drive vehicles—were also viewed positively by more than 80 percent of respondents.

“The accelerating shift toward hybrid and electric vehicles gives automakers both a challenge and an opening,” said Mike Yakima, product principal for vehicle intelligence solutions at LexisNexis Risk Solutions. “Consumers are responsive to timely, personalized communication across multiple channels. Those who embrace this evolution can turn the fragmentation of the market into a durable advantage.”

LexisNexis Risk Solutions says automakers can access the full survey results to refine customer engagement and retention strategies—particularly by leveraging garage-level data and consumer affinity insights that capture how and why Americans decide their next ride.