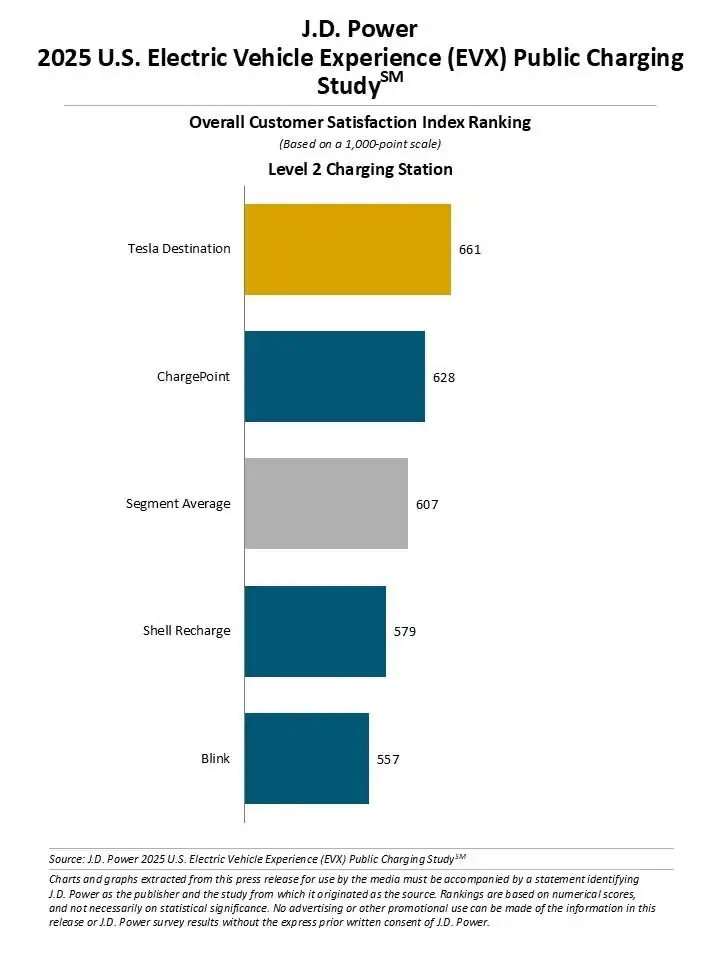

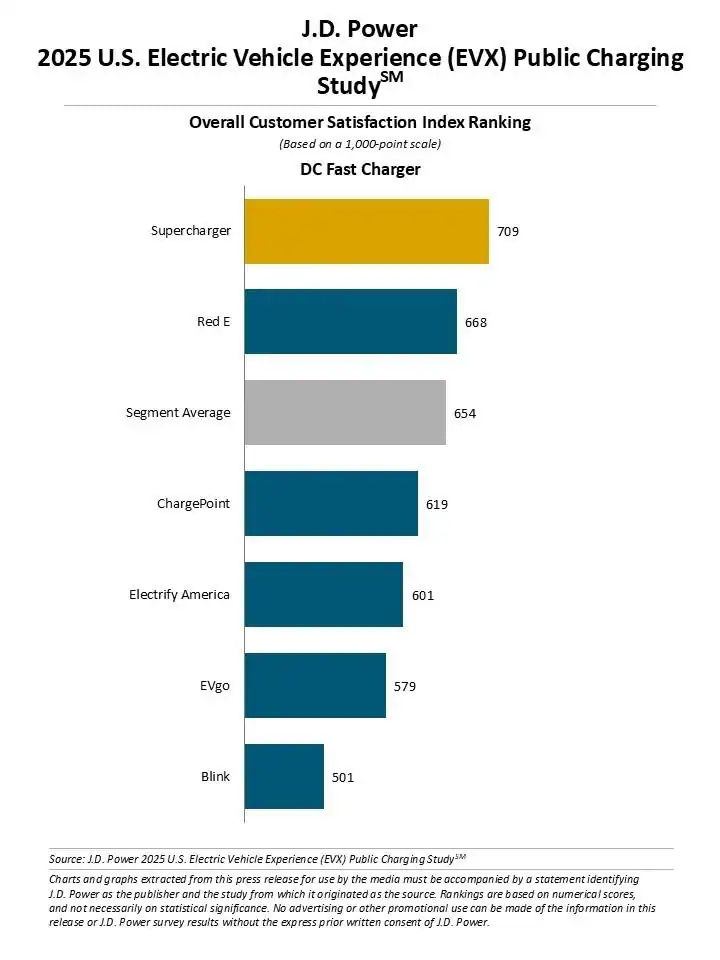

Still, the gains in dependability stand in contrast to slipping satisfaction scores, pointing to tensions between access and affordability. Overall satisfaction with DC fast chargers dipped to 654 on J.D. Power’s 1,000-point scale, down ten points from a year earlier; Level 2 public chargers scored 607, a seven-point year-over-year decline. These slides underscore a growing malaise over the cost and ease of payment, with satisfaction in those categories plummeting 16 points for both Level 2 (now 459) and DC fast (now 430) charging. It appears that as charging infrastructure has matured—launching beyond early subsidies and introductory pricing—users are more sensitive to fees and billing friction.

Tesla Still Tops—but OEM Networks Are Rising

Within the shifting landscape, Tesla remains the leader, topping both segments: its Destination Level 2 charger network scored 661, and Superchargers achieved 709, both besting network averages. Yet traditional benchmarks are being challenged: combined OEM-operated networks—from Mercedes-Benz, Rivian, and Ford—tie Tesla with a collective DC fast charging satisfaction score of 709, hinting at growing competition, even if their smaller footprint disqualified them from formal ranking. Third-party chargers trail behind with an average DCFC score of 591, underscoring the difficulty of offering consistent, high-quality service to a broad and diverse customer base.

Locale plays a sharp role in user experiences. The Pacific region leads with 21 percent of non-charge visits, accompanied by 12 percent wait times, while the East South Central region fares best—only 7 percent of drivers fail to charge, and just 5 percent encounter waits. Urban contrasts are also stark: in Seattle (25 percent) and Los Angeles (24 percent), drivers most commonly report unsuccessful charging attempts; meanwhile in San Francisco (18 percent) and Denver (14 percent), the bigger headache is waiting in line to charge. What’s consistent across regions: about 60 percent of non-charge visits stem from chargers being out of service—reflecting persistent maintenance and operational gaps.

**First-Time EV Owners Are More Forgiving; Affordability Looms Large**

One of the study’s more striking findings: first-time EV owners express higher satisfaction than seasoned adopters. Among Level 2 chargers, novices scored 610, compared with 592 by veteran users. With DC fast chargers, newbies rated 654, while veterans rated 648. J.D. Power suggests this may reflect elevated expectations from long-time EV drivers, who perhaps better anticipate technological maturity that current charging systems have not yet delivered.

Brent Gruber, J.D. Power’s executive director of its EV practice, framed the results with cautious optimism: “While overall satisfaction scores decline this year, our data shows clear improvement in the reliability and success of public charging—a promising sign of progress for the industry.” He emphasized that speed is not the panacea. Instead, improving reliability, user-friendliness, and cost transparency must drive the next phase of infrastructure development—especially as NEVI-related funding remains unpredictable.

The EVX Public Charging Study, now in its fifth year, polled 7,428 BEV and PHEV owners between January and June 2025. It evaluates satisfaction across ten key dimensions—from the physical condition of stations to convenience, safety, cost, and payment ease. While the industry touts reduced non-charging incidents as a signal of progress, the declining ratings on cost and usability suggest these technical gains must be matched by improvements in customer experience—particularly for long-term EV adoption.