Why it matters:

-

EV and ICE coexistence: GM’s decision reflects a nuanced approach—while many competitors pivot exclusively to EVs, GM is hedging, securing ICE output to maintain revenue through the transition.

-

Job and supplier impact: These investments will support regional jobs and local supply chains, reinforcing GM’s position amid a politically sensitive backdrop, including shifting tariffs.

-

Market surge readiness: With demand for EVs rising, GM aims to prevent capacity bottlenecks as it scales production of its Ultium-powered lineup.

-

Balanced investment strategy: GM’s dual investment signals that legacy automakers still value traditional engines—buying time to scale EV production without forsaking cash flow.

-

Market ripples: Both developments come amid geopolitical uncertainty—tariffs, rare-earth access, and Chinese competition—requiring automakers to be agile, politically savvy, and strategically aligned.

-

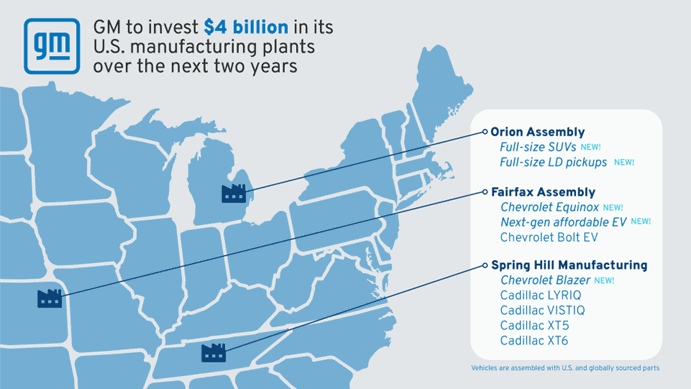

The $4 billion will be divided among several key facilities across Michigan, Tennesee and Ohio. A substantial portion will go to GM’s Orion Assembly plant in Michigan, which will be retooled to build the company’s next-generation electric trucks. The investment will fund new tooling, advanced battery integration systems, and modernized assembly lines, helping the plant become a cornerstone of GM’s EV manufacturing network.

“General Motors is investing in the present and the future,” said GM Chair and CEO Mary Barra in a statement. “These investments reflect our commitment to American manufacturing and to providing our customers with a diverse portfolio of vehicles—electric and gas-powered—through this transition period.”

The move comes as the U.S. auto industry straddles a complex moment in its history. EV adoption is steadily growing, supported by federal incentives and rising consumer interest, but infrastructure limitations, high battery costs, and range concerns remain barriers for many drivers. At the same time, ICE vehicles—especially pickups and large SUVs—continue to account for the lion’s share of U.S. auto sales.

Orion Assembly, Orion Township, Michigan – General Motors announced that it will begin manufacturing gasoline-powered full-size SUVs and light-duty pickup trucks at its Orion Assembly plant starting in early 2027. The move comes in response to sustained consumer demand for internal combustion engine (ICE) vehicles. As a result, GM’s Factory ZERO in Detroit-Hamtramck will transition to exclusively producing electric vehicles, including the Chevrolet Silverado EV, GMC Sierra EV, Cadillac ESCALADE IQ, and both pickup and SUV variants of the GMC HUMMER EV.

Fairfax Assembly, Kansas City, Kansas – The Fairfax plant is set to begin production of the gasoline-powered Chevrolet Equinox in mid-2027. The Equinox, which underwent a major redesign, saw sales jump by more than 30% year-over-year in the first quarter of 2025. In addition, Fairfax remains on schedule to begin building the all-electric 2027 Chevrolet Bolt EV by the end of 2025. GM also signaled future investments in the plant to support its next generation of affordable EVs.

Spring Hill Manufacturing, Spring Hill, Tennessee – Production of the gas-powered Chevrolet Blazer will be added at the Spring Hill facility starting in 2027. The plant will build the Blazer alongside an expanding portfolio of EVs, including the Cadillac LYRIQ and VISTIQ, as well as the Cadillac XT5.

“We believe the future of transportation will be driven by American innovation and manufacturing expertise,” said GM Chair and CEO Mary Barra. “Today’s announcement underscores our commitment to building vehicles in the U.S. and supporting American jobs. We’re focused on giving customers more choice with a broad lineup of vehicles they love—whether gas or electric

Industry analysts see GM’s strategy as a pragmatic approach. “GM is threading the needle between electrification and profitability,” said Jessica Caldwell, executive director of insights at Edmunds. “They recognize that ICE vehicles still have a strong demand base and are using that revenue to fund the future of their EV business.”

In recent years, GM has made major commitments to EVs, including its pledge to sell only zero-emissions vehicles by 2035 and its partnership with LG Energy Solution to build Ultium Cells battery plants. This latest investment reaffirms that strategy, but it also underscores the company’s recognition that the path to full electrification will be gradual—and that flexibility is crucial.

Union leaders have expressed support for the investment, which is expected to create or retain thousands of jobs. The UAW applauded the announcement as a “win for American workers” and emphasized the importance of bringing high-tech EV jobs under union contracts.

As GM navigates the evolving automotive landscape, the $4 billion investment reflects a balancing act between innovation and pragmatism. With EVs representing the future and ICE vehicles still fueling the present, GM’s latest move positions it to compete on both fronts—ensuring stability today while building the foundation for tomorrow.